Managing Your Money In College

Managing your money in college is by far the hardest thing to do, and the easiest thing to screw up after taking just ONE shopping trip with your friends.

It’s nothing new hearing the cliche ‘broke college student’ joke being thrown into the universe every now and again by a real-life college student who is, in fact, broke.

I know I’ve labeled myself as ‘broke’ plenty of times over the last three years—knowing the honesty behind my words. It’s not easy having to juggle a life where you're in-between in all sense of the word. In-between jobs, homes, sanity, you catch my drift.

With three years under my belt and two of those years being financially supported by a part-time job, I’ve gathered enough experience handling my money to understand what did and did not work for me as a part-time worker and full-time student.

A while back I published another related post on Making Money in College, so check that out if you're interested in learning how to hustle your way across some extra cash—legally, of course.

Comment below if you have any more tips to share with others and make sure to follow my college journey on Instagram, Twitter, and Facebook for more spontaneous tips and updates on my road to walking the stage!

First off, since we, as students, tend to make mistakes as we learn more about the adult world and what is has to offer—I thought it necessary to share what NOT to do with your money. Please understand that there is always wiggle room if you are employed or have a large pocket filled with money (even then I wouldn't recommend spending it carelessly, but that’s neither here nor there).

what not to do with your money

1. Spend it all on fast food

Our financial downfall is camouflaged as burritos and fried chicken. What I have been guilty of in the past is relying on fast food to fill my stomach on a near day-by-day basis. This, my friends, is not only ruining your health but robbing your pockets. I can't begin to explain how beneficial it is to buy your own groceries and get creative with cooking. I am living in a DORM ROOM right now, yet I rely solely on the groceries I buy and appliances allowed or offered by my dorm hall to sustain me. I will be posting a helpful 'Dorm Room Meals' youtube video and blog post soon. (subscribe to my channel so you don’t miss out).

2. Shop before you pay bills

This may sound like a “duh Makayla” tip, but believe me when I say that college students do this on a daily basis, unknowingly. Before you head to the mall, even if it’s to purchase a $10 dress you saw on sale, pay all of your bills that are both due and anticipated. Do not touch money that is not yours to touch. If you have a debt of any sort and an empty tank of gas (which I consider a bill to help with budgeting), you need to keep your card at the back of your wallet until you're certain that money isn't needed.

3. Skip transferring money to your savings

Please, coming from a college student with a dangerously small savings balance, do NOT skip saving money you earn or are given. Saving money is investing in yourself and your future, which is both an opportunity and blessing I refuse to take for granted. If you have $10 to save, transfer it before you can think twice and know that $10 per month will add up if made into a monthly or weekly habit.

Now that the depressing section is over with, I wanted to share some of my top money-management tips that have helped me both save and earn money as a full-time (and currently jobless) college student.

what to do with your money

1. Find ways to save money without knowing

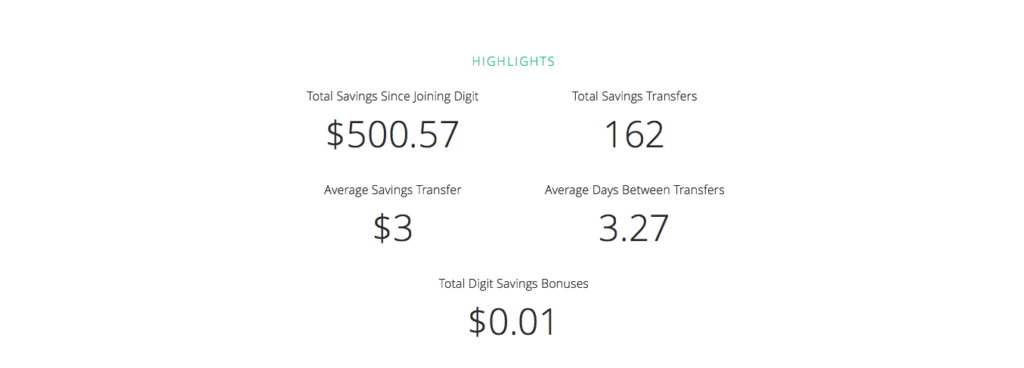

If you read my Making Money in College post, you would've seen me mention my FAVORITE savings program, Digit. Digit, long story short, is a FDIC-safe automated banking service that can be controlled through your phone or their handy app. As you can see in the picture below, I’ve saved $500 since signing up around a year ago, which is a lot for one year considering how many times I’ve paused this service during tough times.

If you want to try it out for yourself, check them out here and watch a short video to learn more!

If you're disciplined enough to do so without the help of saving programs, make it a point to save a decent percentage of your income each month or set aside money during the holidays and birthdays. Remember, saving your money can be considered making an investment in YOURSELF.

Saving your money is investing in your future. Do it. Share on X

2. Budget your money with or without an income

For the last two years, I’ve had a job to supplement my already struggling college lifestyle. With that extra money, I made the mistake of NOT budgeting my income and, essentially, spending more than I should have.

Make it a point to mentally or physically set aside the necessary amounts for each bill or future expense, knowing that it’s better to start out with less rather than needing more later on.

For my last semester (fall 2016), things got a bit stressful due to me making the executive decision to not work. I had to anticipate how much I would need for food weeks in advance and consider a trip to the movies or a fast food meal that I wanted to treat myself to within that month…It’s not easy, and quite annoying, but is DOES work and saves you from financial trouble later down the line.

3. Find and invest in GOOD DEALS when shopping

I hack my way into saving money even when I’m shopping or purchasing necessary items! There is no shame in being an extreme ‘couponer' or having a few apps on your phone to make your life easier. A few apps I use to shop and save a coin are RetailMeNot and Ebates.

RetailMeNot is your online coupon companion with thousands of deals each day from thousands of different stores. One feature I love, if you're okay with making your location visible to the app, is their location feature where they notify you when you're near a store that has an available coupon!

I also use Ebates, as the true hustler that I am, which is an online shopping site that gives you cash back for every purchase! I know, it sounds too good to be true but it’s not. I’ve personally gravitated more towards online shopping lately and utilize this website to make money as I spend money. Check it out for yourself if you're interested in signing up for free.

Another way to save money while purchasing necessities is to buy secondhand textbooks! I usually purchase and even SELL old textbooks to eCampus and Chegg for extra cash or good deals. If your books are taken care of, congrats are in order. If not, please do not pay full price!

There are plenty of other tips out there in the universe for managing your money in college, but these are a few that I hope can help you the most. I’m sure you’ll see plenty of your peers purchasing new Micheal Kors purses and traveling to Dubai while you're eating ramen noodles on the floor because you can't afford a foldable chair.

Stay in YOUR LANE and know yourself enough to be content with your portion. Things, money and extra ‘stuff’ will come in time. These years are for you to learn and prepare for the monster of adulthood.

I hope this post can be applied to your life in some way! Join my mailing list for extra tips and updates on my new website, Blogging Bosses, that will launch soon for all of my creative entrepreneurs and YouTubers! Share this post and Pin it to Pinterest to spread the love.

Speaking abundance into your life for 2017 and the years to come,

-Miss Lynn

This page contains affiliate links to programs and networks I personally use and enjoy. All opinions are my own! If you want to learn more visit my Disclosure Policy page or Contact Me with any further questions.

I’m going to have to check out that app, thanks for all the tips!

xo, Syd

anchoredinthesouth.com